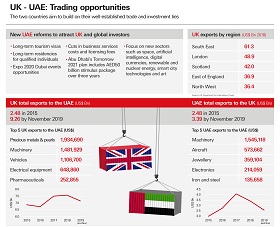

The UAE-UK trade relationship is going from strength to strength. British companies are being encouraged to seek new investments in the UAE, and UAE investors are in turn looking at fresh business opportunities in a post-Brexit world.

The UAE is the largest recipient of UK foreign direct investment in the Middle East North Africa and Türkiye (MENAT) region. UK foreign direct investment in the UAE grew to U.S.$8.3 billion by the end of 2017, compared to US$3.2 billion in 2013. Key areas of investment include education, energy, infrastructure, healthcare, renewables and financial and professional services.

Following a period of diversification, the UAE has become a major regional trading and tourism hub and provides a gateway to the Middle East’s most important economic centres. "We have the most remarkable transformation in history happening here today, in the Middle East, over US$2 trillion infrastructure spend, and with some of the events happening, the eyes of the world are on the Middle East today" said Daniel Howlett (Regional Head of Commercial Banking, Middle East, North Africa and Türkiye).

Instrumental in the establishment of a banking sector across the MENAT region1, and with Headquarters of the HSBC Group in London, HSBC is uniquely placed to help UK businesses make the most of opportunities that exist between the UK and the UAE.

Get in touch with us today to find out how HSBC can help you access opportunities between the UK and the UAE