The introductory module of the HSBC Sustainable Business Accelerator, set the scene for participants joining the programme. The discussion focused around defining what an ESG strategy is and the importance of having a transparent reporting framework to align with stakeholder expectations, where Regulators and consumers are increasingly demanding clear reporting by companies. The role of the private sector in advancing climate and environmental targets is crucial for achieving our global climate and environmental objectives. Following the six-month programme will enable participants to have a measurable ESG strategy in place for their business by the end of the year.

Establish a Strategy

An Environmental, Social, and Governance (ESG) strategy is a business plan that incorporates environmental, social, and governance factors into business decisions, risk management, and performance tracking. It reflects the company's commitment to achieving financial results in a manner that is socially responsible and sustainable. The goal is to help companies identify and manage ESG risks and opportunities and align their operations with the principles of sustainable development. This can lead to numerous benefits for organizations, namely an improved management of ESG risks, sizing ESG-related opportunities, strengthened stakeholder relations, enhanced brand reputation, better access to sustainable finance, improved long-term financial performance, and ensuring compliance with the changing ESG regulatory landscape.

Typically, an ESG strategy outlines what, why, how, when, and for how long relevant initiatives are carried out by a company. The ‘why’ refers to the mission and vision that define a company’s ESG values. The ‘what’ establishes the goals to be achieved and which reporting metrics and frameworks are going to be used to monitor and evaluate the progress towards those targets. The ‘how’ defines the tactics that are going to be carried out as part of the strategy, and the ‘when’ sets up the timeframe in which the different initiatives will take place.

Industry Stakeholders Must Act Now

The climate and environmental emergency we are currently facing has elevated the importance of sustainable development in ensuring the preservation of our planet. As originally defined in the 1987 Brundtland Commission Report, sustainable development refers to development that satisfies the present needs without compromising the ability of future generations to fulfill their own needs.

The 2030 Agenda for Sustainable Development, adopted by all United Nations Member States in 2015, is built upon this concept, providing a shared blueprint for fostering peace and prosperity for people and the planet, both now and in the future. The agenda also originated the 17 Sustainable Development Goals (SDG) as the key objectives to secure a sustainable development model.

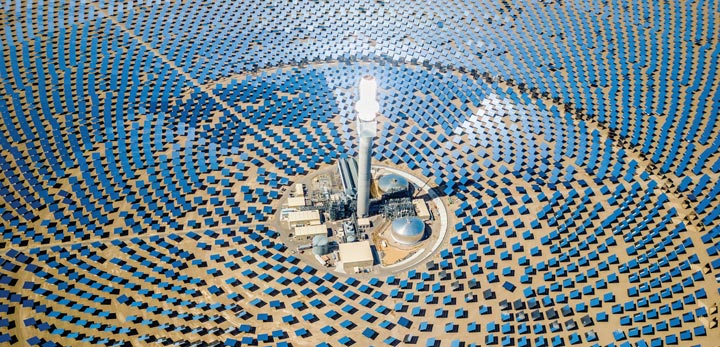

Industry and the private sector are poised to play pivotal roles in the pursuit of sustainable development. Without heightened efforts and commitments from private organizations, achieving a more sustainable development model will remain elusive. This sentiment is echoed by a recent poll conducted by Diginex, in which 83% of participants identified SDG 9 (building resilient infrastructure, promoting inclusive and sustainable industry, and fostering innovation) as the most crucial sustainable development goal.

The Emergence of ESG

ESG factors have become popular frameworks to analyze the environmental impact and commitments from organizations, including CO2 emissions, energy efficiency, and waste management. ESG also factors in the performance of companies in social aspects, such as human rights, health and safety, equality, and diversity; and governance issues, including ethics, levels of transparency, and anti-corruption policies and regulations in place.

Prior to ESG, Corporate Social Responsibility (CSR) had become the term of choice during the mid-late 20th century to embody the idea that corporations have a responsibility to society in addition to their shareholders. Later, Sustainability emerged as a broader concept emphasizing the ‘triple bottom line’ – people, planet, and profit – and calling on businesses to integrate social, environmental, and economic impacts into their strategies.

The concept of ESG has emerged in the past two decades and now broadly defines corporate sustainability. ESG incorporates ideas from previous terms, but also makes environmental, social, and governance factors specific and measurable, and integrates them into business strategies, risk assessments, and operations.

ESG Gains Momentum

Growing investor interest and access to capital, environmental and social risks, increasing regulatory pressure, and consumer demands are among the factors pushing organizations to have a solid ESG strategy. In the Middle East, North Africa, and Turkey market (MENAT), the sustainable loan market reached $23 billion in 2021, and the sustainability bond market grew to $9.1 billion, representing 268% year-on-year growth.

Operational risk assessments are expected to benefit from ESG. In its 2023 Global Risks Report, the World Economic Forum identified failures to mitigate and adapt to climate change, natural disasters, and extreme weather events as the top global risks. Besides their severe impact on the environment and populations, those events also pose a threat to business operations. Integrating ESG risk management into core strategies will grow in importance to effectively navigate such threats, as well as more immediate ESG-related risks, such as reputational issues. Effective risk management under this context can ensure the long-term viability and success of businesses.

The preference for sustainable products and services is also on the rise among customers and B2B clients. Companies that can meet that criteria will reap the benefits of greater market share, strengthened brand reputation, and customer preferences. A 2022 PwC survey focused on the Middle East found that responding companies perceive enhanced brand reputation as a key benefit of implementing an ESG strategy.

Disclosure mandates on corporate ESG performance have surged globally, with 34 stock exchanges currently mandating ESG listing requirements, and 71 providing guidance on ESG reporting. Moreover, regulators are following the same path. From 2023, the EU requires over 50,000 large and listed companies to report on ESG through the new CSR Directive, which will be extended to the entire economy over the next five years. In the US, the Securities and Exchange Commission (SEC) is drafting regulations to mandate disclosures on greenhouse gas emissions and other climate-related financial metrics and qualitative disclosures.

In regions like the Middle East and North Africa, ESG has become a top priority for both industry and government. Regional stock exchanges such as the Qatar Stock Exchange, Bahrain Bourse, and Saudi Exchange have published ESG disclosure guidelines. Governments have launched their respective national long-term strategies, including different net-zero and decarbonization targets.

Supply chains, estimated to contribute to approximately 60% of global emissions, are also receiving greater attention within industry ESG strategies. Transport and logistics are two major sources of greenhouse gas emissions. An increasing number of organizations are placing more emphasis on reducing carbon emissions in their transportation systems. A prime case in point is the US retailer Walmart. The company operates one of the largest road fleets in the country, covering 1.1 billion miles annually. This accounted for about 25% of the company’s emissions in 2020, according to their 2022 net-zero report. As part of their decarbonization efforts, the company improved their fleet’s fuel efficiency by 87% during the period 2005 to 2014.

Large corporations are increasing ESG disclosure requirements for suppliers to comply with certain environmental standards. Canadian bank BDC's data estimates that the proportion of major purchasing organizations that require their suppliers to disclose ESG information is expected to reach 92% in 2024.

Aligning ESG Strategies with Stakeholder Expectations

ESG strategies can assist organizations in aligning with stakeholder expectations by promoting a higher level of transparency. Globalization and digitalization have led to an increase in the number of stakeholders that are demanding greater transparency and accountability from organizations. Consequently, companies are intensifying their efforts to ensure the accuracy and quality of their ESG reporting. A study by PwC revealed that 59% of companies publishing ESG reports in the MENAT region have undergone formal audits, and an additional 25% plan to take this step in the coming year. Ensuring such a level of ESG reporting is pivotal not only to meet stakeholder expectations but also for aiding organizational management decision-making.

Credibility and accuracy in reporting are also essential for the success of ESG strategies in the eyes of external stakeholders. Companies are coming under increased scrutiny for deceptive environmental advertising, portraying their actions to be greater than they are - or greenwashing. The costs of this can be substantial, encompassing reputational damage, stock value losses, substantial fines, and changes in management.

Identifying Material ESG topics

The role of the private sector in advancing climate and environmental targets is crucial for achieving our global climate and environmental objectives. The emergence of ESG is critical in incentivizing industry players to take further actions by leveraging the multiple benefits of establishing a robust ESG strategy. This also involves providing more accurate and transparent data that can benefit all stakeholders, enabling them to make better-informed decisions and effectively manage ESG risks.

An important aspect of this process is conducting a thorough materiality assessment, which assists different organizations in identifying the specific ESG issues they can most effectively address and that are most relevant to their particular business. This topic will be further analyzed in Module 2 of the HSBC Sustainable Business Accelerator.