- Article

- Innovation & Transformation

- Improve Efficiency

Imerys Ceramics Egypt Breaks the Mold with Digital Treasury

There are huge benefits that can come from moving from a manual to a digital treasury set-up.

Manual treasury processes are time-consuming, prone to error and exposed to operational risks. For Imerys Ceramics Egypt, it was time to go digital.

Imerys is a French multinational company and the world’s leading supplier of industrial mineral-based specialty solutions. It operates in 40+ countries with 16,000+ employees. Its group subsidiary Imerys Ceramics Egypt, located close to the City of Cairo, is a manufacturing facility producing a range of sanitary-ware, tableware, and tiles, which has been operating since 2014.

Imerys wanted to enhance its treasury management operations and move away from manual processes by adopting digital solutions that could automate and streamline its Egypt treasury function. While addressing its local operational needs, it also wanted to improve visibility and control of the Egypt operation back to Treasury HQ in France.

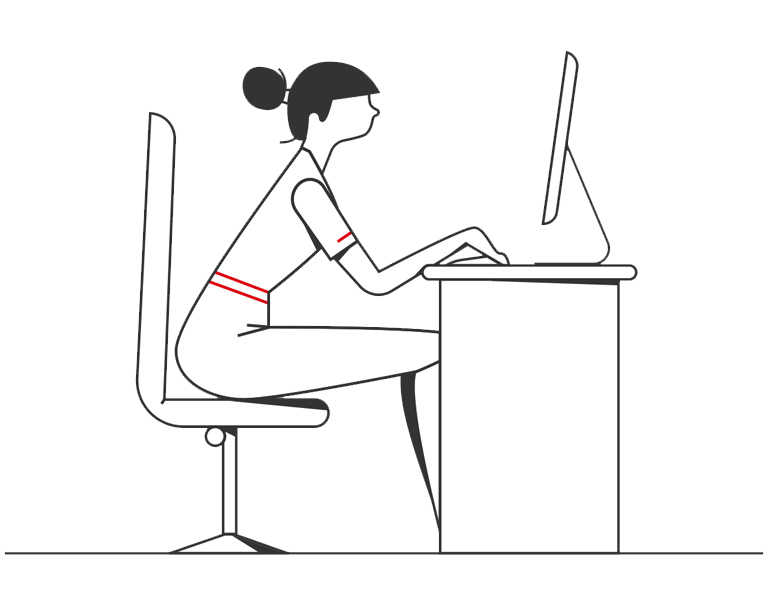

The key challenge facing Imerys was the number of manual processes that were being undertaken by the treasury team in Egypt. Manual forms were required to make vendor and salary payments using ACH and RTGS transaction rails. Similarly, cheque issuances were also manual. This, coupled with no internal integration via an approval matrix (initiator and approver), further impaired the company’s ability to easily track and monitor cheques raised against payments executed.

Furthermore, cheque collections required safe keeping within the office and necessitated daily visits to the branch to deposit on-due date for funds draw down. Statutory payments such as government taxes, social insurance and customs payments had to be signed manually and submitted to the branch for processing for every transaction.

Decentralised, manual reconciliation meant that statements were printed and manually cross-referenced to track inward collections against sales. This meant that managing payables and receivables reconciliation was both time-consuming and prone to error and risk.

An extra challenge came with reporting. The company could not automatically pull MT940s from its incumbent banks, nor could it automatically reconcile and report back to France HQ. Moreover, reporting and reconciliation on the monthly cheque collection status could also only be was being done manually as there was no integrated reporting option for the post-dated cheque collection held in the company’s safe.

The company had multiple banking partners, which led to multiple bank logins, passwords, and tokens. Accessing daily cash positions was time-consuming and cumbersome.

The company’s existing banking platform had no channel integration options. Consequently, it was unable to set up an approval matrix on these channels or make use of Straight Through Processing (STP) functionalities. To ensure transactions were processed, the treasury team were required to call their bank to validate that online payment requests were actioned. Its local banking partners had limited to no international footprint.

With such an array of challenges, Imerys Egypt looked for solutions. They selected HSBC as their single core treasury and banking partner on the basis of HSBC’s international footprint and wide range of cash management solutions that would streamline its local treasury and cash management.

The solutions included:

- Simplifying bank account reconciliation with enhanced connectivity using SWIFT MT940 to provide end-of-day statements for cash balance visibility and control, capitalising on the existing SWIFT master profile with HSBC in France.

- Opening one single bank account for making payments and receiving collections across all instruments – cash, cheque, electronic transfers (ACH and RTGS) – all centralised payments through HSBC.

- Using standardised payment formats and implementing straight through processing (STP) that automate payment processes from initiation to execution, optimising operations and removing manual intervention.

- Integrating E-Bills for government payments on the e-channel, enabling statutory payments to be automatically settled with the biller.

- Cheque Outsourcing (COS) for the digital issuance of electronically signed cheques, automating the company cheque payment process.

- Express Banking, which is a customised door-to-door pick-up and delivery service of cheques for processing at HSBC that removes the need for branch visits and outsourced non-core business activities to HSBC.

- Warehousing post-dated cheques, Outsourced storage of cheques to HSBC which reduces the burden and risk of warehousing the cheque where the bank collects, safely stores, and monitors due dates of post-dated cheques until the clearing date when they are deposited for draw down.

- Using HSBC’s Receivables Management system, which provides different types of cheque collection reports for reconciliation and information.

- Using the Liquidity Management Dashboard in order to consolidate visibility over cash flows along with enhanced reporting while also covering third-party bank reporting.

Such was the success of the treasury transformation project that Imerys Ceramics Egypt’s employees wanted to gain similar benefits. From the comfort of their company premises, HSBC coordinated with the company to open both Premier and Advance staff accounts for 15 employees so they could have similar high-end personal banking services, including personal credit cards and other facilities.