- Article

- Raising Finance

- Business Planning

MENAT Professional Services sector performance improves amid watchful optimism

HSBC's latest regional Professional Services Roundtable brought together senior leaders to discuss the sector dynamics, the economic and COVID-19 impacts, alongside government policy and risks, going into 2021

The professional services sector in the MENAT region is looking forward to a more stable mid-to longer-term planning horizon in a mood of watchful optimism after having performed above expectations, so far, during the pandemic.

In another of its Virtual Boardroom series, HSBC brought together senior leaders from the sector across Accountancy, Law, Consulting, and Recruitment with risk and outlook updates from Sorana Parvulescu, Partner at Control Risks, and an economic update from James Pomeroy, HSBC Global Economist.

With companies adjusting to the new challenge, the leadership priorities have evolved from a perceived urgent need to review the partnership and operating model back in March, to the current focus on operational efficiency, strategy, purpose, values, and the development of people skills and capability

While COVID-19 continues to challenge economies across the globe, the divergent nature of the world’s response to the pandemic is likely to result in a fractured rebound in 2021, presenting ongoing challenges to the sector and particularly the clients of professional advisory firms.

However, early signs of green shoots of economic recovery, and government appetite for transformation and regulatory change in the region, suggest that 2021 is likely to be a more stable year bolstered by the pent-up demand of consumers eager to move on with their lives, and by vaccines expected to gradually start winning the war against COVID-19.

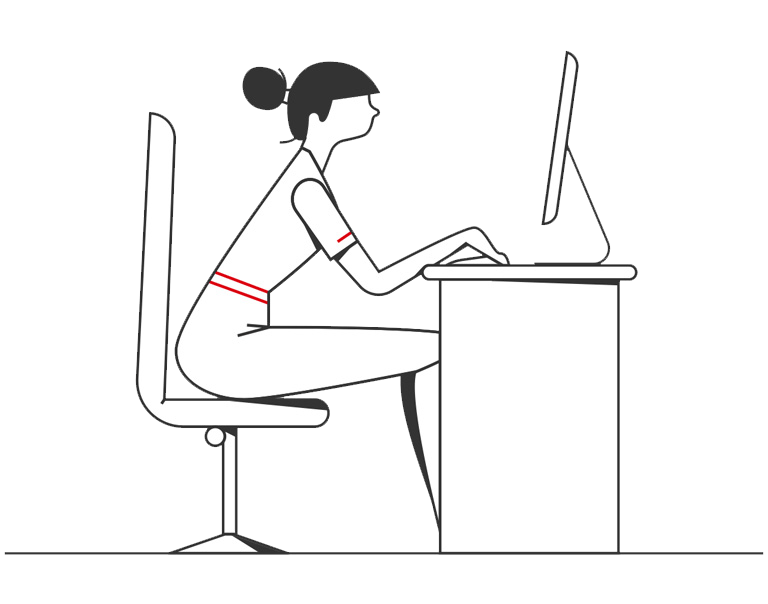

Mental health issues among employees, alongside the concern for effective technical and personal development of young talent are likely to remain lasting challenges for the sector’s leadership in a business environment where working remotely feels like a permanent change to operating routines and culture.

The younger generation has been the most impacted group in the sector this year, prompting a serious concern amongst its leadership. “The development and training of the young generation is the key challenge that we are facing,” one delegate told the panel. A need has emerged to balance the efficiencies of remote working and advances in communication techniques, with clear benefits of an office location where younger talent can integrate, learn, and network with their experienced senior colleagues. “There is no substitute for the mark-up with lots of green pen,” another delegate stated.

Vaccine rollouts signal a fractured rebound

The euro zone economy was expected to decline by 8.3 percent in 2020 due to the impact of COVID-19, compared with a 1.3 percent expansion in 2019, before recovering to a 5.2 percent real GDP growth in 2021, according to the IMF’s World Economic Outlook update from October. Given a new strain being discovered in the UK and the reaction of European countries to this and ongoing lockdowns it remains to be seen if this forecast is impacted further through the winter.

In China, on the other hand, recovery is starting to broaden out. The world’s No. 2 economy is expected to grow by 2.1 percent in 2020, according to another Reuters poll, the weakest pace in 44 years but still making it the only major global player to expand this year.

The expected increase in the predictability of US policy following the November elections, the potential for the US to return to the Paris Agreement, and the successful development of several COVID-19 vaccines provide a few reasons for optimism for 2021, according to Parvulescu.

The headwinds remain, however, given challenges related to vaccine distribution, a more lukewarm stance towards the region from the new US administration, and potential disruption caused by unrest from a young unemployed population, who suffered from lockdowns and their consequences.

A significant world divergence in response to COVID-19, the future of US-China relations, the risk of further job losses and bankruptcies from new lockdowns, and the Georgia Senate run-offs in the US will all be critical to the global economic outlook.

With signs of nascent recovery emerging in various parts of the world, sustained low interest rates, shift to online, and end of cash are offering further optimism for economic growth. Coupled with government spending on healthcare, green transport, new industries, infrastructure, and re-skilling, pent-up demand is expected to kick in during the second half of 2021, providing a further boost.

While an unprecedentedly quick development of vaccines against COVID-19 offers some hope and concern, economies around the world are unlikely to be completely out of the pandemic going into 2022 with the real impact of vaccines not expected to be felt before at least the middle of 2021.

That is likely to lead to a fragmented world, which will have places that would distribute the vaccine early on, and enough infrastructure and administrative and financial power to be able to administer it efficiently, and others who will not have a chance to even get their hands on it.

As a result, travel restrictions are likely to continue going forward. The anticipation is that travel is not going to return to the high point of previous years for quite a while to come.

Once vaccines start to get deployed, delegates are optimistic that things will begin to return to “normal”, helping people revive thinking about where to invest and where the next opportunity might come from.

ESG to dominate government policy

The ESG agenda is going to dominate a lot of government policy and spending in the next few years, as it improves people’s lives, reduces pollution, and develops new jobs and industries.

Delegates called on Professional Services firms to look out for which sectors are likely to benefit from government stimulus, as spending focus moves from subsidies to incentives for renewable energy. This will have long-term implications for the Middle East.

According to Pomeroy, the big social push to a green future means that the long-term oil price outlook is a bit more negative than the current expectations of US$45-US$55 per barrel price range.

As the pandemic rages on, there has been also more difficulty in hiring foreign expat skilled workers with some firms adopting recruitment policies targeting the localisation of employees, the delegates said.

Such policies are in line with a long-term government drive across the region to increase participation of local workers in the private sector.

How companies adapt in terms of pay and where to hire from will be an interesting trend to follow, and it may represent a tipping point to a more globalised workforce, while local expertise should serve as a key consideration in the recruitment process, the panelists said.

Foreign policy and digital shift

In foreign policy, a landmark deal on normalisation of relations between Israel and the United Arab Emirates, followed by Bahrain, may open new business opportunities, showing the region in a different light and generating further opportunities for Professional Services firms.

Looking further out, news of Saudi Arabia’s new supply chain financing, enabling contractors to secure money owed to them faster, alongside recent changes in the UAE family inheritance and other laws, are also likely to improve investors’ view of the region.

With the big digital shift accelerated by COVID-19 and the incoming cohort of young people having grown up entirely online, expectations are that as much as 50% of consumer spending is likely to be online by 2030.

With businesses increasingly connected to digital payments, shifting away from cash in the emerging world could potentially mean a 3% rise in GDP by 2025, according to HSBC Global Research.

This means that governments across the world are also going to have to pour money into investments in IT and technology such as AI. The pandemic has shown that robust economies have also been the most digitally savvy, the delegates concluded.

Within the landscape of challenge and opportunity there is a more positive impact on the business environment across MENAT for Professional Services firms.

With the onset of progress on the vaccine front, government’s appetite for economic transformation, and examples like the UAE’s efforts to make the country more attractive to foreign investment, the opportunity for Professional Services firms to contribute to the new “normal” remains a watchfully optimistic outcome.